Reading time: 7 minutes

Published: September 13, 2024

Modified: January 28, 2025

When it comes to investing in diversified portfolios, you’ve likely come across both mutual funds and exchange-traded funds (ETFs). While they may seem similar, there are some key differences that could impact your investment strategy, particularly when it comes to costs and flexibility. In this post, I’ll explore mutual funds versus ETFs, guide you on how to find ETFs that closely match mutual funds, and provide an example of building a similar portfolio using ETFs to reduce expenses.

Key Takeaways

- Mutual Funds vs. ETFs: While mutual funds offer professional management and convenience, ETFs often provide lower costs and more flexibility, especially for hands-on investors.

- Lower-Cost Alternatives: You can often find ETFs that mirror mutual funds, offering similar asset allocations but with lower expense ratios, which can significantly impact long-term returns.

- Building an ETF Portfolio: By combining ETFs, you can closely replicate the performance of a mutual fund.

- Using Portfolio Visualizer: Tools like Portfolio Visualizer allow you to compare the historical performance of your custom ETF portfolio against mutual funds, helping you fine-tune your investments for better results.

The Key Differences Between Mutual Funds and ETFs

At a high level, both mutual funds and ETFs allow you to invest in a basket of securities, offering diversification. However, how they operate and their cost structures can be quite different.

Mutual Funds:

- Mutual funds are managed by professionals who make decisions about the allocation of the fund’s assets. You typically purchase shares at the net asset value (NAV), which is calculated once at the end of the trading day.

- They’re ideal for automatic contributions and dollar-cost averaging since shares are purchased based on the NAV, avoiding intraday price fluctuations.

Pros:

- Active management can provide opportunities for growth and income.

- Simplifies the investing process, especially for long-term investors.

Cons:

- Expense ratios tend to be higher due to active management.

- Many mutual funds have sales charges or “loads,” further increasing the cost.

- Less flexibility, as trades are executed only at the end of the trading day.

- Mutual funds distribute capital gains and income, which can trigger taxes even if you don’t sell your shares.

ETFs:

- ETFs trade on an exchange like individual stocks, and their price fluctuates throughout the day. This gives you the flexibility to buy and sell whenever the market is open.

- While some ETFs are actively managed, most are passively managed and track an index, keeping costs significantly lower.

Pros:

- Lower expense ratios, especially for passively managed funds.

- Increased flexibility since you can trade them throughout the day.

- ETFs rarely distribute capital gains due to their “in-kind” creation and redemption process, meaning you won’t be taxed until you sell your shares.

- Tax efficiency makes them a better option for taxable accounts.

Cons:

- You may need to pay a brokerage commission when buying or selling shares.

- Requires a more hands-on approach for management, especially if rebalancing is needed.

How to Find ETFs That Mirror a Mutual Fund

If you’re currently invested in a mutual fund and are interested in transitioning to a similar ETF with lower costs, the good news is that the industry has been evolving to create ETFs that closely resemble mutual funds.

To find an ETF that matches your mutual fund, start by analyzing the mutual fund’s holdings, investment objectives, and sector allocations. For example, does the mutual fund focus on large-cap stocks? Bonds? International markets? This will help you determine the characteristics you need in an ETF.

Next, use research tools like Morningstar ↗ to screen ETFs to compare expense ratios, sector weightings, and historical performance. In many cases, you’ll find ETFs that track the same index as your mutual fund but at a fraction of the cost.

Example Portfolio: Replacing Vanguard’s VWINX with ETFs

Another tool I recommend is VettaFi’s Mutual Fund to ETF Converter ↗. You search for a mutual fund, and the tool generates a list of ETFs that you might consider as a substitute for your mutual fund. This is particularly helpful when your mutual fund doesn’t track a single index.

For example, let’s take a look at Vanguard’s Wellesley Income Fund (VWINX) ↗. It is a well-known balanced mutual fund that holds a mix of 2/3 in intermediate-term bonds and 1/3 in large value-oriented stocks, aiming for a conservative approach to both income and capital appreciation.

When you search for VWINX, the VettaFi tool generates two tables—one for corporate bond ETFs and one for large cap value equities ETFs (click here ↗ to see the results). To choose an ETF from each table, I sorted by assets and selected the funds that had the largest asset sizes; that seemed list a reasonable criterion to use.

To build an ETF portfolio similar to VWINX based on this criterion, you can use the following:

- Vanguard Intermediate-Term Corporate Bond ETF (VCIT ↗) for the fixed-income portion (2/3 of the portfolio). VCIT invests in investment-grade bonds, providing the same exposure to stable, income-generating assets as VWINX’s bond holdings.

- Vanguard Value ETF (VTV ↗) for the equity portion (1/3 of the portfolio). VTV focuses on dividend-yielding, large-cap value stocks, much like VWINX’s stock component.

This combination closely mimics VWINX’s asset allocation and risk profile but with the added benefit of lower expenses. Both VCIT and VTV are passively managed, meaning you’ll pay significantly less in fees compared to holding VWINX.

For example, the expense ratio of VWINX is 0.31%; the expense ratio for VCIT and VTV is 0.04%.

Performance Comparison: ETF Portfolio vs. VWINX

Now that you have your ETF portfolio in place, it’s time to see how it performs compared to VWINX. A tool like Portfolio Visualizer ↗ allows you to backtest this portfolio and compare its historical performance with the mutual fund.

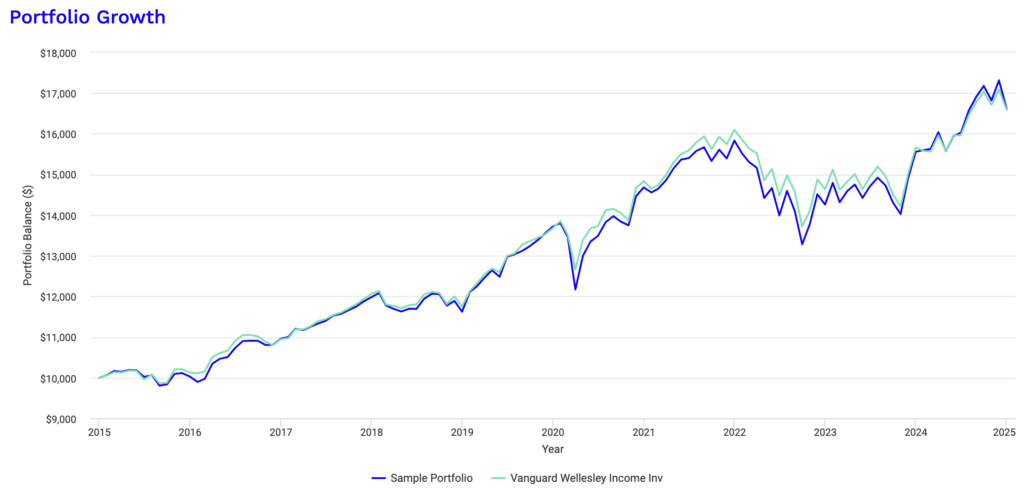

I’ve created a Sample Portfolio using the ETF allocations of 66% and 34% for VCIT and VTV, respectively. The Portfolio Analysis Results ↗ shows you how this portfolio’s returns, risk, and volatility stack up against VWINX for a $10,000 investment over the time period of January 2015 – December 2024.

This chart clearly shows that the performance of the sample portfolio and VWINX mirror each other very closely:

© 2025 SRL Global

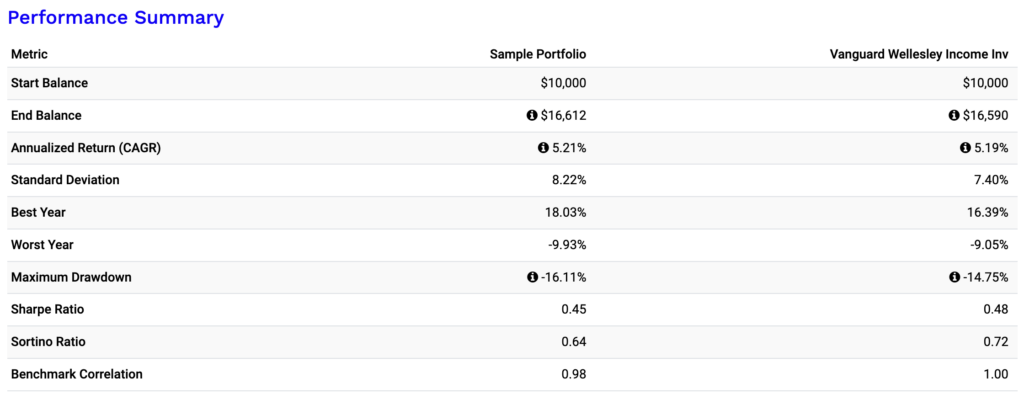

The table below provides valuable financial metrics that allow you to compare more than just performance. For example, the sample portfolio is a bit more volatile than VWINX:

- Its best and worst years were higher and lower, respectively, than those of VWINX.

- Its maximum drawdown, which occurred between January 2022 – September 2022, was -16.11% compared to-14.75% for VWINX.

© 2025 SRL Global

Conclusion: Choosing the Right Strategy for You

Whether you choose mutual funds or ETFs depends on your investment goals, management style, and sensitivity to costs. While mutual funds may be more convenient for long-term investors looking for hands-off management, ETFs offer flexibility and lower costs, making them a solid choice for those who want more control over their portfolio.

Remember, to mirror the performance of a balanced mutual fund like VWINX, you must periodically rebalance the underlying ETFs to maintain the split of 66% for bonds and 34% for stocks. For example, if stocks appreciate faster than bonds and become 44% of your portfolio, you’ll have to sell enough of the stock ETF and buy enough of the bond ETF to bring the allocation back to the 66/34 split. Unless there’s a sudden major change in these percentages, you shouldn’t have to rebalance your portfolio more than 3-4 times a year.

Check out our Rebalancing Calculator to effortlessly rebalance your portfolio and keep your allocations on track.

By understanding the key differences and exploring ETF alternatives to mutual funds, you can create a portfolio that aligns with your financial goals while minimizing expenses. And with tools like Portfolio Visualizer, you can easily compare performance and tweak your strategy to maximize returns.

For more information on ETFs, see Buffered ETFs Protect Your Portfolio from Market Volatility.

And remember, it’s always a great idea to chat with your financial or tax advisor to make sure your decisions are right on track and aligned with the latest guidelines and laws.