Reading time: 8 minutes

Published: September 23, 2024

Modified: June 21, 2025

Are you looking for a way to invest in the S&P 500 but worried about unpredictable market swings? Buffered ETFs protect your portfolio from market volatility and might be the perfect solution. These innovative funds offer the best of both worlds—downside protection to shield you from major losses, while still allowing you to benefit from market growth. Whether you’re a conservative investor or nearing retirement, buffered ETFs provide a way to stay in the market with less risk and more peace of mind.

Why Consider Buffered ETFs?

Buffered ETFs, also known as defined-outcome ETFs, provide a “buffer” that absorbs a portion of market losses while capping the potential gains. For example, during a significant market drop, like the one seen during the COVID-19 pandemic, these ETFs can reduce the impact on your portfolio. However, the trade-off is that the upside is capped, meaning that in a bull market, your returns might be limited. This structure makes buffered ETFs an attractive option for those seeking stability without exiting the market entirely.

Key Takeaways:

- Buffered ETFs offer a buffer against certain levels of market declines, with a cap on returns.

- These funds are designed for investors who prioritize risk management over maximizing growth.

- Costs associated with Buffered ETFs tend to be higher than traditional ETFs due to their complex structure involving options.

How Do Buffered ETFs Work?

Buffered ETFs typically use call and put options strategies to provide downside protection and participation in the upside. These funds aim to limit losses up to a pre-defined buffer, but they also cap gains at a certain level. This creates a structured outcome that protects against a portion of market drops while also ensuring limited participation in market upswings.

For instance, if the market falls by 10%, a buffered ETF with a 5% buffer will only expose the investor to the first 5% of that loss, shielding them from the additional decline up to a predetermined level. However, if the market rallies significantly, the gains will be capped, so you won’t fully participate in any extreme growth.

Investing in Buffered ETFs: Is It Right for You?

Buffered ETFs are ideal for investors who want to remain in the market but are worried about volatility. These funds are particularly useful for conservative investors nearing retirement, who may want to protect their portfolios from significant losses, or for those who have a lower risk tolerance but still want exposure to equities like the S&P 500.

PSCQ: A Case Study in Risk Management

One specific example of a buffered ETF is the Pacer Swan SOS Conservative (October) ETF (PSCQ) ↗. This ETF is designed to track the S&P 500 while offering downside protection and capped gains over a 12-month period. The mechanics of PSCQ make it an attractive option for investors who are concerned about both sharp declines and missing out on market growth.

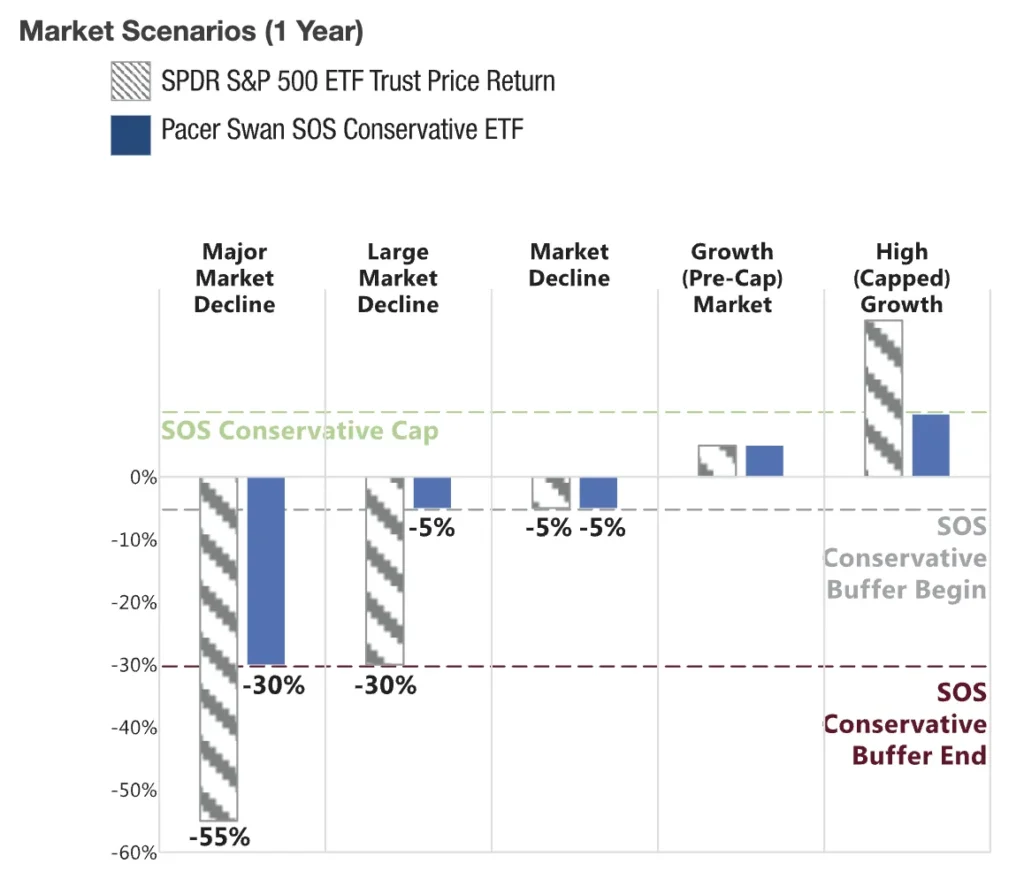

- Buffer Level: PSCQ protects against losses between 5% and 30% over a one-year period. This means if the S&P 500 drops by 20%, investors would only experience a 5% loss. Not until the S&P 500 drops below 30% does a PSCQ investor participate in the downside. See Figure 1 for an illustration of these market scenarios.

- Cap Level: The fund caps gains at 15.95% before fees and expenses. If the market rises beyond this, investors in PSCQ would not capture any further gains.

- Roll Period: Each year, the ETF resets its buffer and cap levels. For the upcoming investment period from October 1, 2024, to September 30, 2025, PSCQ will again set a new buffer and cap based on market conditions at the time.

Important Consideration

The structured outcomes for buffered ETFs, such as the Pacer Swan SOS Conservative (October) ETF (PSCQ), are designed to be fully realized only if you hold shares for the entire duration of the investment period. This means you need to purchase shares on the first day of the investment period and continue to hold them until the last day of that period.

If you buy shares after the investment period begins or sell them before it ends, the investment returns you experience can differ significantly from the outcomes the fund aims to provide. It’s important to note that there is no guarantee that the fund will achieve its stated investment objectives, especially if shares are bought or sold during the investment period.

Comparing the Performance of PSCQ to the S&P 500

So, we know how PSCQ is supposed to perform in theory, but how does it perform in real life? Using Portfolio Visualizer ↗ to compare a $10,000 investment in PSCQ and the SPDR S&P 500 ETF Trust (SPY ↗) from January 2022 to the March 31, 2025 (see graph below), note that PSCQ and SPY end with a value of about $12,289 and $12,308.

To my knowledge, PSCQ did not exist prior to January 2022; if it had, it’s likely that SPY would have outperformed it over the course of the last 10 years when the SPY had stellar returns.

Also notice that PSCQ is indeed buffered on the downside and only falls below the level of SPY on the upside, which is exactly how it’s designed. For example, the lowest value of the $10,000 investment in PSCQ was $9,155 on September 30, 2022. On that same day, the investment in SPY was also at its lowest value at $7,607.

To illustrate the behavior of a buffered ETF versus the non-buffered ETF that it tracks, consider these metrics from the Performance Summary of the Portfolio Visualizer:

| Metric | Pacer Swan SOS Conservative (PSCQ) | S&P 500 (SPY) |

|---|---|---|

| Compound annual growth rate (CAGR) | 6.55% | 6.60% |

| Standard deviation (measure of volatility) | 7.1% | 17.2% |

| Best year | 19.8% | 26.2% |

| Worst year | -4.4% | -18.2% |

| Maximum drawdown (Jan. 2022 – Sept. 2022) | -8.5% (recovered by March 2023) | -23.9% (recovered by Dec. 2023) |

These metrics highlight how PSCQ’s buffered approach results in a steadier performance with less downside risk and volatility, even if it comes at the cost of capping potential gains during strong market years.

- CAGR: Each fund offers a similar annual growth rate.

- Standard Deviation: PSCQ’s volatility is significantly lower, illustrating how its buffer helps to cushion against market swings.

- Best Year: PSCQ’s best year return is lower, reflecting the cap on upside performance. While it protects against major losses, the trade-off is that investors in PSCQ will not fully benefit from exceptionally strong market gains.

- Worst Year: In its worst year, PSCQ’s loss is significantly smaller than SPY’s, thanks to its buffer that shields against substantial market declines. This protection helps preserve capital during sharp downturns, minimizing the emotional and financial toll of deep losses.

- Maximum Drawdown: PSCQ’s smaller drawdown and faster recovery demonstrate the power of its buffer. By limiting exposure to the full extent of market drops, PSCQ can rebound more quickly, reducing the time investors spend “underwater” compared to SPY, which took longer to recover.

Cost Consideration

Buffered ETFs usually come with a higher expense ratio than traditional ETFs due to the complexity of its structure. The expense ratio for PSCQ is 0.60%, which reflects the additional management and strategy costs involved in offering both protection and limited upside. In my opinion, this is a reasonable expense and is comparable to many actively managed non-buffered funds.

When deciding whether to include buffered ETFs in your portfolio, it’s important to weigh these fees against the benefits of downside protection.

Portfolio Strategies with Buffered ETFs

Incorporating buffered ETFs into your portfolio allows you to balance risk and reward more effectively. For conservative investors, a higher allocation to buffered ETFs like PSCQ may provide the protection needed during market downturns, while still allowing for participation in market growth. Younger investors, on the other hand, may opt for a smaller allocation to these funds, as they might be willing to take on more risk for the possibility of greater returns.

Conclusion: Managing Risk with Buffered ETFs

Buffered ETFs like PSCQ offer a way to stay invested in the market while limiting downside risk. By absorbing losses within a defined range and capping gains, these funds strike a balance between safety and growth, making them an excellent choice for conservative investors or those nearing retirement. However, the higher expense ratios and capped returns should be considered when evaluating if buffered ETFs fit your investment goals.

Curious if you can manage risk by building a portfolio of ETFs designed to weather any market condition? Dive into The Truth About All-Weather Funds: Are They Realistic?.

As always, it’s essential to assess your financial objectives and risk tolerance with your financial advisor when deciding whether buffered ETFs are the right fit for your portfolio.